Indicators on How Do I Get A Copy Of Bankruptcy Discharge Papers You Should Know

How To Get Copy Of Bankruptcy Discharge Papers Fundamentals Explained

Table of ContentsSome Of How To Get Copy Of Bankruptcy Discharge PapersThe Basic Principles Of Chapter 13 Discharge Papers The Buzz on Copy Of Bankruptcy DischargeUnknown Facts About Chapter 13 Discharge Papers5 Easy Facts About How To Get Copy Of Bankruptcy Discharge Papers Shown

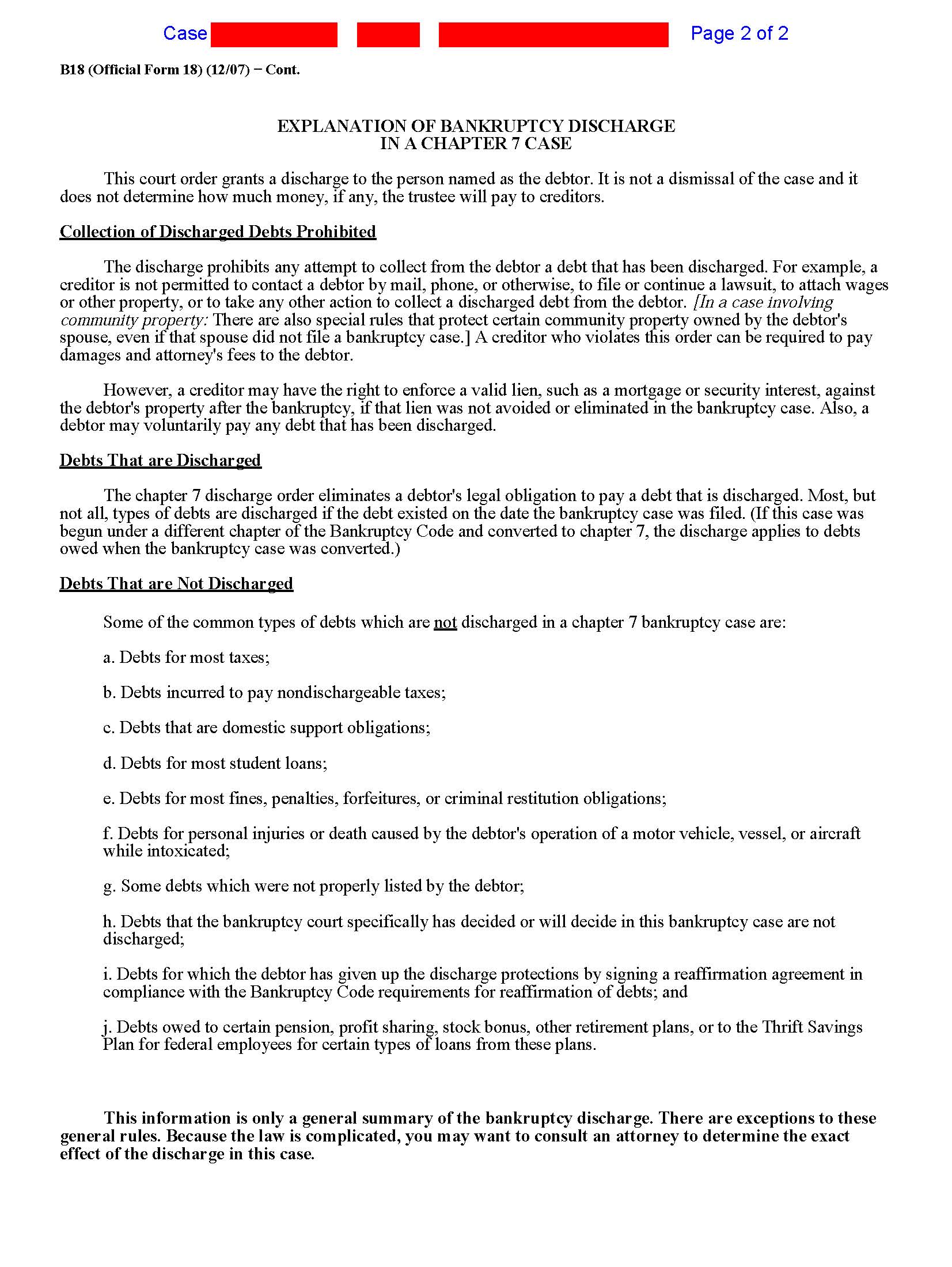

A specific debtor under Chapter 7 personal bankruptcy is usually given a discharge; nonetheless, the right to a discharge is not guaranteed. There might be pending litigation involving objections to the discharge. The Federal Rules of Personal bankruptcy Treatment offer the clerk of the bankruptcy court to send by mail a copy of the order of discharge to all financial institutions, the united stateThe debtor and also the debtor's lawyer also receive duplicates of the discharge order. The notice is merely a duplicate of the last order of discharge and is not particular to the debts the court establishes ought to not be covered by the discharge. http://cali.edu.co/index.php/comunicacion/foro/business-directory?start=60. The notification educates lenders that the debts owed to them have been released as well as they ought to not attempt any kind of more collection.

In enhancement, valid liens on certain home to protect settlement of financial debts that have actually not been released will stay basically after the discharge, and also a secured lender can implement the liens to recoup such home. As stated over, creditors listed on the discharge are not allowed to call the borrower or pursue collection task, and a debtor may submit a report with the court if a financial institution violates the discharge order.

Copy Of Bankruptcy Discharge Things To Know Before You Get This

Many customers might find it challenging when they get debt after receiving a discharge. Although they might be released from their financial commitments, personal bankruptcies remain on their document for a duration of 7 to one decade, depending upon the kind of personal bankruptcy filed. Consumers may try to reconstruct their credit report documents with protected bank card and also fundings.

Nonetheless, employers can not fire an existing worker who is going or has gone via the procedure of bankruptcy. A court can reject a discharge in Phase 7 for a number of factors, including, to name a few, the debtor's failure to offer tax obligation files that have actually been asked for, devastation or concealment of publications or records, offense of a court order, or an earlier discharge in an earlier case that began within eight years prior to the day the 2nd application was submitted, and also failing to finish a course on individual monetary monitoring.

trustee might file an objection to the borrower's discharge. A discharge might likewise be refuted in Chapter 13 if the borrower does not complete a course on personal economic monitoring or if they've gotten a prior discharge in one more Chapter 13 case within 2 years before the filing of the second situation, with a few exemptions - https://www.cnet.com/profiles/b4nkruptcydc/.

Not known Details About How Do I Get A Copy Of Bankruptcy Discharge Papers

Bankruptcy Trustee, as well as the trustee's attorney. The trustee directly handles your bankruptcy instance. This order includes notice that financial institutions should take no further actions to collect on the financial debts, or they'll deal with penalty for ridicule. Maintain a duplicate of your order of discharge along with all your various other bankruptcy documents.

You can submit an activity with the insolvency court to have your case reopened if any kind of creditor attempts to collect a discharged financial debt from you (how do you get a copy of your bankruptcy discharge papers). The lender can be fined if the court identifies that it went against the discharge injunction. You can try simply sending a duplicate of your order of discharge to quit any kind of collection activity, and after that speak to an insolvency attorney about taking legal activity if that does not function.

How Do I Get A Copy Of Bankruptcy Discharge Papers for Beginners

They include: Domestic responsibilities such youngster support, alimony, and financial obligations owed under a marital relationship settlement contract Particular fines, charges, and also restitution resulting from criminal activities Specific tax obligations, consisting of fraudulent revenue taxes, real estate tax that came look here due within the previous year, and also business taxes Court costs Financial debts connected with a DUI infraction Condominium or other property owners' organization fees that were imposed after you declared personal bankruptcy Retired life plan finances Financial debts that weren't released in a previous bankruptcy Financial obligations that you failed to detail on your bankruptcy request Some debts can not be discharged under Chapter 13 bankruptcy, consisting of: Child assistance and also spousal support, Particular penalties, penalties, as well as restitution arising from criminal tasks, Particular tax obligations, including illegal income taxes, residential or commercial property taxes that became due within the previous 3 years, and organization taxes, Debts you really did not list on your bankruptcy request, Financial debts incurred as a result of accident or death triggered by driving while intoxicated, Financial obligations emerging from fraud or recent deluxe purchases Creditors can ask that certain debts not be released, also if discharge isn't forbidden by law.

Just your personal liability for the financial obligation is gotten rid of when you receive your personal bankruptcy discharge. Creditors can still collect from, or also sue, cosigners and also joint account owners for discharged financial obligations.

The discharge occurs after all the settlements under the payment strategy have been made in a Phase 13 insolvency, normally three to 5 years. A bankruptcy discharge successfully removes specific financial debts. Financial institutions can no more attempt to accumulate on discharged financial obligations, although they can still seize building that's been vowed as security for those financial obligations.

Rumored Buzz on Obtaining Copy Of Bankruptcy Discharge Papers

Debtors must be aware that there are numerous choices to phase 7 relief (chapter 13 discharge papers). For instance, borrowers who are participated in service, including companies, partnerships, as well as sole proprietorships, might favor to remain in service and stay clear of liquidation. Such borrowers need to think about filing an application under chapter 11 of the Personal bankruptcy Code.

Fed. R. Bankr. P. 1007(b). Borrowers have to likewise supply the assigned situation trustee with a duplicate of the tax return or records for the most recent tax year as well as tax obligation returns filed throughout the case (consisting of tax obligation returns for previous years that had not been filed when the instance started).